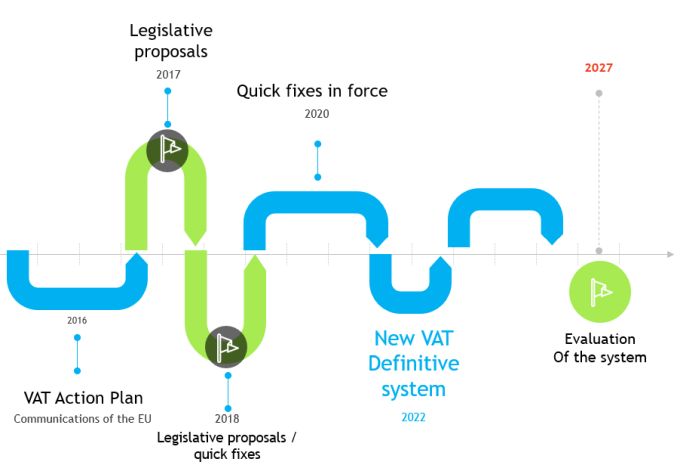

11 April 2016 1. European Commission publishes VAT Action Plan On 7 April 2016, the European Commission tabled its VAT Action P

VAT Gap: EU countries lost €140 billion in VAT revenues in 2018, with a potential increase in 2020 due to #Coronavirus - EU Reporter

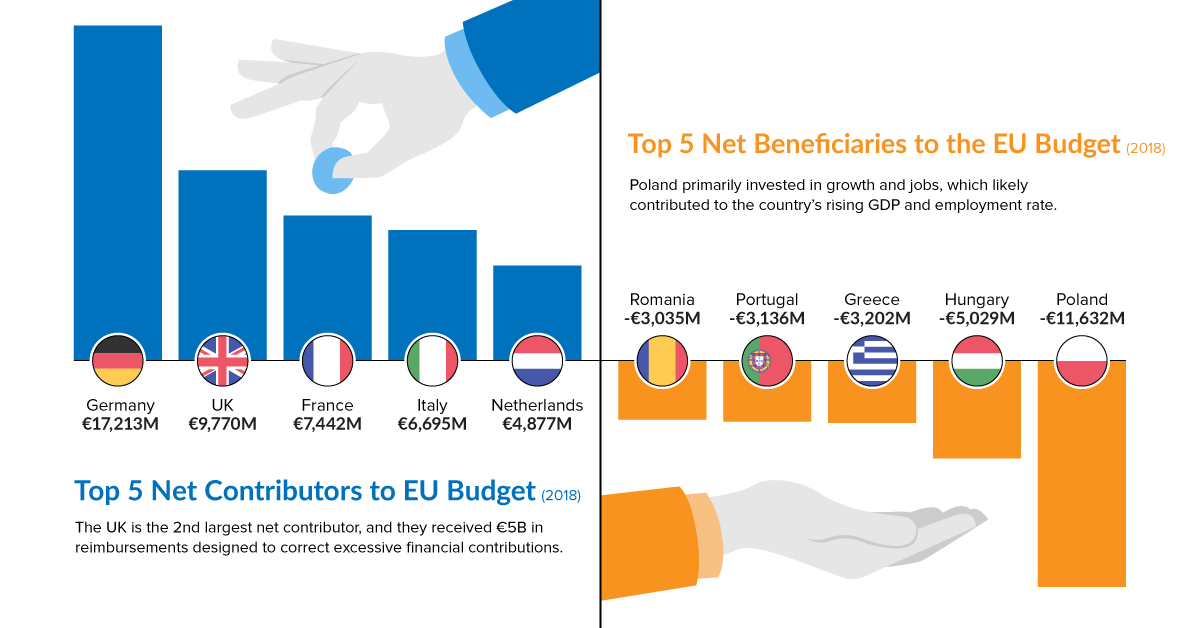

EUROPEAN COMMISSION Brussels, 7.12.2018 SWD(2018) 493 final COMMISSION STAFF WORKING DOCUMENT Tax Policies in the European Unio

European Commission released VAT Gap Frequently asked questions | Onestopbrokers – Forex, Law, Accounting & Market News